Why Is Diversity Important? The Answer Might Surprise You

Meltdowns are all Chris Clearfield & Andras Tilcsik Why Is Diversity Important? The Answer Might Surprise You around us.

Hardly a month goes by without a major accident, a corporate scandal, a technology failure, or some other surprising fiasco. In recent few decades, many systems, from the electrical grid and the food supply to our computers and cars, have become significantly more sophisticated and capable. But they’ve also become more complex and less forgiving, which makes them vulnerable to surprising failures.

In the past five years, we reviewed hundreds of academic studies and interviewed a broad swath of people—social scientists, CEOs, NASA engineers, pilots, regulators, technology experts, accident investigators, and many others—to understand why such failures keep occurring and what we can do to prevent them. Many of the solutions we came across weren’t particularly surprising: redesigning systems to make them less vulnerable, using decision tools to make better choices, listening to skeptics, and understanding small failures to avoid big ones.

But we didn’t expect to learn that one of the best safeguards against meltdowns is diversity.

Pundits and business gurus often talk about how diversity can spark creativity and innovation. Diversity, they tell us, is supposed to be something beautiful: Different people come together to learn from one another and create an inclusive team that’s more than the sum of its parts. Everyone brings something special to the table, and the collaboration of unique individuals leads to amazing new ideas

But it turns out that diversity is often more painful than beautiful—and that’s exactly why it’s so valuable in complex environments. It helps because it makes things harder.

To understand why, consider how the lack of diversity affects us. Psychologists have found that we tend to trust the judgment of people who look similar to us. As a result, homogeneous groups reduce tensions and make for smooth, effortless interactions, which is not necessarily a bad thing. It can be easier to get things done when we are confident that we can rely on our peers’ judgment. But it turns out that homogeneity makes things too easy. It leads to too much conformity and not enough skepticism.

Diversity, in contrast, is less familiar and feels less comfortable. It’s a potential source of friction. And that makes us more skeptical, more critical, and more vigilant. When we are on a diverse team, we don’t trust each other’s judgment quite as much, so we’re able to call out the naked emperor. And that’s extremely valuable when dealing with complex, unforgiving systems. When small errors can be fatal, giving others the benefit of the doubt when we think they are wrong is a recipe for disaster. Instead, we need to dig deeper and stay critical. Diverse teams help us do that.

In other words, diversity is like a speed bump. It makes us work harder, snaps us out of our comfort zone, and makes it hard to barrel ahead without thinking. Dozens of research studies support this conclusion. Let’s look at a few of them.

Skeptics in the Stock Market

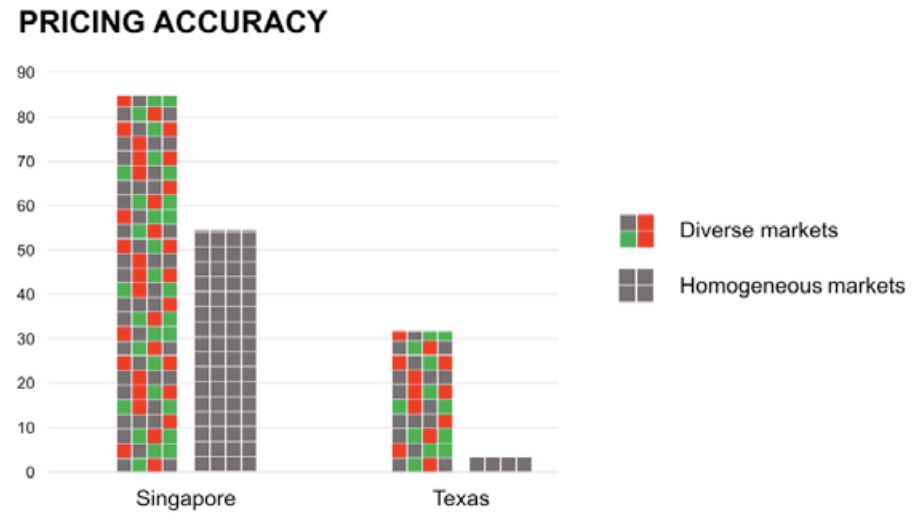

One landmark study involved realistic stock-trading simulations with dozens of groups in Singapore and Texas. To explore the effects of diversity, the researchers randomly assigned some groups of traders to be ethnically homogeneous (i.e., all traders were from a single ethnic group) or ethnically diverse (a mix of Chinese, Indians, and Malays in Singapore, and a mix of African Americans, Latinos, and whites in Texas).

Before participants started to trade, they sat in a waiting room so they saw the people they would be trading with. They were then escorted to individual cubicles with a computer and a trading screen and received instructions on how to calculate the value of the stocks. And then they began trading for real money.

The researchers were most interested in the accuracy of trades: How close were the prices to the correct values of the stocks, based on the information available to the participants? Accuracy was measured on a scale from 0% to 100%, with higher scores signifying higher accuracy.

In both locations, people priced stocks much more accurately when they were in diverse company. And they were more likely to copy each other’s mistakes when they were in a group of people who looked like them. As a result, homogeneous markets led to more price bubbles— and bigger crashes when those bubbles burst.

One might wonder if diverse groups had come to the stimulation already equipped with better pricing skills. But that wasn’t the case. Before participants started trading, they individually answered questions about several pricing scenarios, and there were no significant differences between the skills of the people in the diverse and homogeneous groups.

Having ethnic minority traders in a market was valuable not because they contributed unique perspectives or knowledge. They helped the markets because, as the researchers put it, “their mere presence changed the tenor of decision making among all traders.” In diverse markets, everyone was more skeptical. People scrutinized each others’ mistakes more intensely and copied them less often. In homogeneous markets, traders trusted one another’s judgments— even when those judgments were wrong.

Combatting Conformity

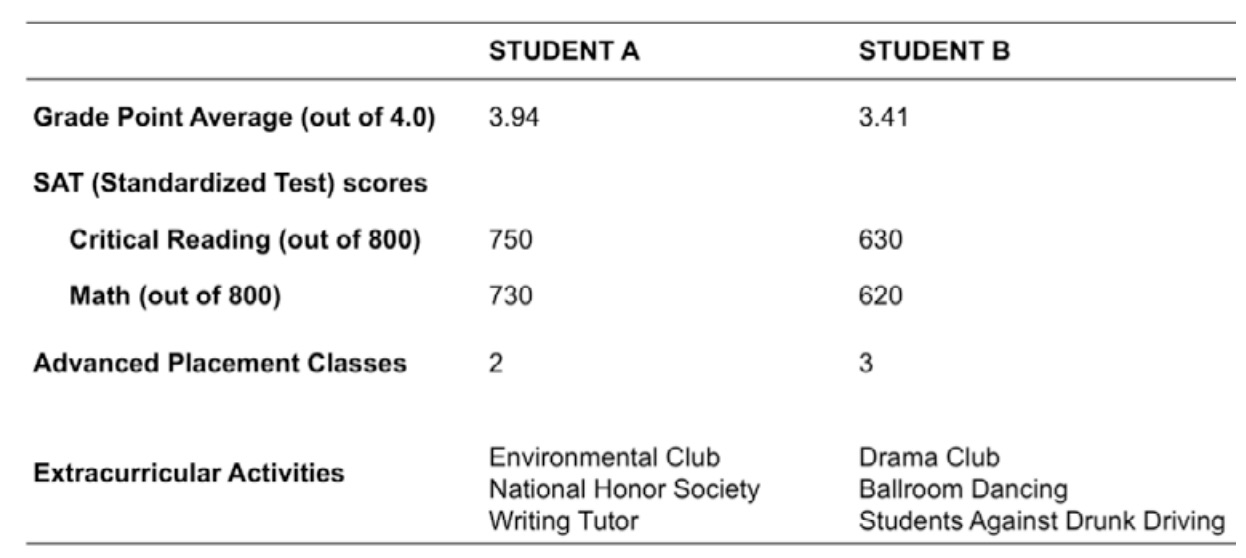

Another recent experiment illustrated this point in a very different context: college admissions. The researchers put together groups of four people and asked each person to evaluate the profiles of high school students who had applied to a top university. Take a look at an example:

Which student do you think would be a better candidate for admission to an elite school? When you ask people individually rather than in a group, most respondents pick Student A. It makes sense. Student A had nearly perfect grades and better test scores. Even though B took one more Advanced Placement course, A is clearly stronger academically. And A’s extracurricular record doesn’t seem any worse than B’s.

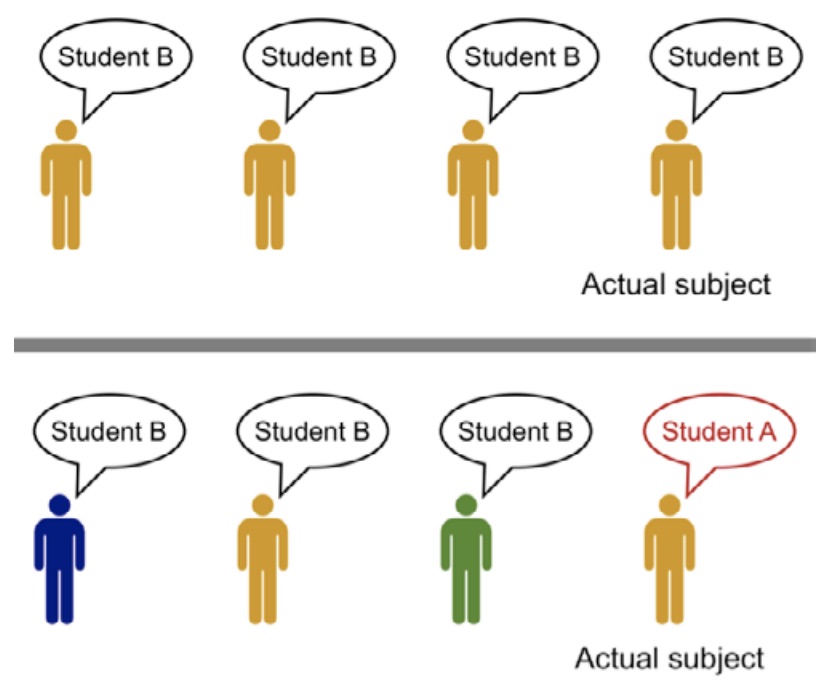

The experiment, however, had a twist. In each group, only one person was an actual subject. The other three people were actors who would all answer incorrectly, saying that Student B was the stronger applicant.

The three actors went first:

“Student B!”

“Student B!”

“Student B”

Then it was the real participant’s turn. Though some people resisted conformity and eventually picked Student A, many went along with the rest of the group, even though Student B was a weaker applicant.

But what’s most interesting about this study is that the researchers varied the level of diversity in the groups. In some groups, both the real participant and the three actors were white. In other groups, the actual participant was white, but two or three of the actors were racial minorities. And that made a big difference. In homogeneous groups, participants often conformed to the group and endorsed Student B. In diverse groups, that happened much less frequently

As in the trading experiment, people in homogeneous groups found ways to rationalize their peers’ mistakes. They tried to think of reasons the others might be right—why the less qualified applicant might be better. In diverse groups, in contrast, people didn’t trust one another’s judgments as much and were less likely to accept the wrong answer.

Law and Order

Researchers have come to a similar conclusion when studying teams making decisions. In one fascinating experiment, teams of three—some racially homogeneous, some diverse—had to solve a complicated murder mystery. There were many suspects and lots of information to sort through. As in many complex environments, no one person knew all the relevant facts. But the team needed all the different clues to solve the mystery.

Diverse teams were more likely to recognize that different team members knew different things. As a result, these teams spent much more time sharing and discussing the clues. “The groups with racial diversity significantly outperformed the groups with no racial diversity,” wrote the lead author of the study, Katherine Phillips. “Being with similar others leads us to think we all hold the same information and share the same perspective. This perspective. . . stopped the all-white groups from effectively processing the information.”

Something similar happens in jury deliberations, too. Racially mixed juries tend to:

- deliberate longer

- share more information

- discuss a wider range of relevant factors

- make fewer mistakes when recalling case facts

It’s not that minority jurors perform better than white jurors. When the jury is diverse, everyone does better.

Winning the Board Game

Gender diversity has similar effects. For example, companies that lack gender diversity on their board of directors are more likely to issue financial restatements—revisions of their previous statements due to error or fraud. A financial restatement is an embarrassing failure and might shake investor confidence, and even a small increase in gender diversity makes it less likely that a restatement will be needed.

Why does diversity have this effect? As accounting professors Larry Abbott, Susan Parker, and Theresa Presley put it, “A more diverse, less cohesive board may be more likely to question assumptions and inquire as to the comparability of accounting with industry practice, resulting in more in-depth discussion and slower decision-making. These actions are consistent with board gender diversity reducing groupthink and leading to an improved monitoring process.”

Diversity in expertise works in remarkably similar ways. A recent study that tracked 1,300 community banks over two decades has found that banks with many bankers on the board were more likely to fail than banks whose directors had come from a wider range of backgrounds: not just bankers but also, for example, lawyers, doctors, retired civil servants, military officers, and nonprofit professionals. Though some of these backgrounds have little to do with banking, diversity in expertise helped banks survive even the global financial crisis.

The research revealed three things that diverse boards had going for them:

• Flexibility. Homogeneous boards often became deeply entrenched in particular ways of doing things; diverse boards were more flexible in responding to new information and unfamiliar situations.

• Skepticism. Homogeneous boards tended to be overconfident; people on diverse boards were more skeptical and often responded to risky proposals by saying “We are not going to make a decision today because you didn’t give us enough information to make the decision.”

• Productive conflict. As one CEO explained, the problem with homogeneous boards that were dominated by experienced bankers is that “everybody respects each other’s ego at that table, and at the end of the day, they won’t really call each other out.” On a diverse board, in contrast, “when we see something we don’t like, no one is afraid to bring it up.”

On diverse boards, in other words, there was a lot of friction: the directors questioned each other’s judgment and took nothing for granted. Bankers didn’t speak the same language as doctors and lawyers, so even “obvious” things had to be explained and debated. Diversity ensured that the board members didn’t work together too smoothly.

Too Little Diversity Where We Need It Most

The kind of friction and skepticism that diversity produces is especially valuable in today’s complex, unforgiving environments, where even small errors can cause big meltdowns, and the cost of being wrong is just too high. Yet, we too often rely on homogeneous teams, even when facing the most complex challenges.

Consider, for example, this statement by Sallie Krawcheck, the former CFO of Citigroup, about the role of homogeneous teams in the global financial crisis:

It was a group of hard-working individuals who miscalled the downturn… They were people who had grown up together, gone to the same schools, looked at the same data over years and years, and came to the wrong conclusions…

I think when you get diverse groups together who’ve got these different backgrounds… there’s permission to say, “I come from someplace else, can you run that by me one more time?” And I definitely saw that happen. But as time went on, the management teams became less diverse. And in fact, the financial services industry went into the downturn white, male and middleaged. And it came out whiter, maler and middle-aged-er.

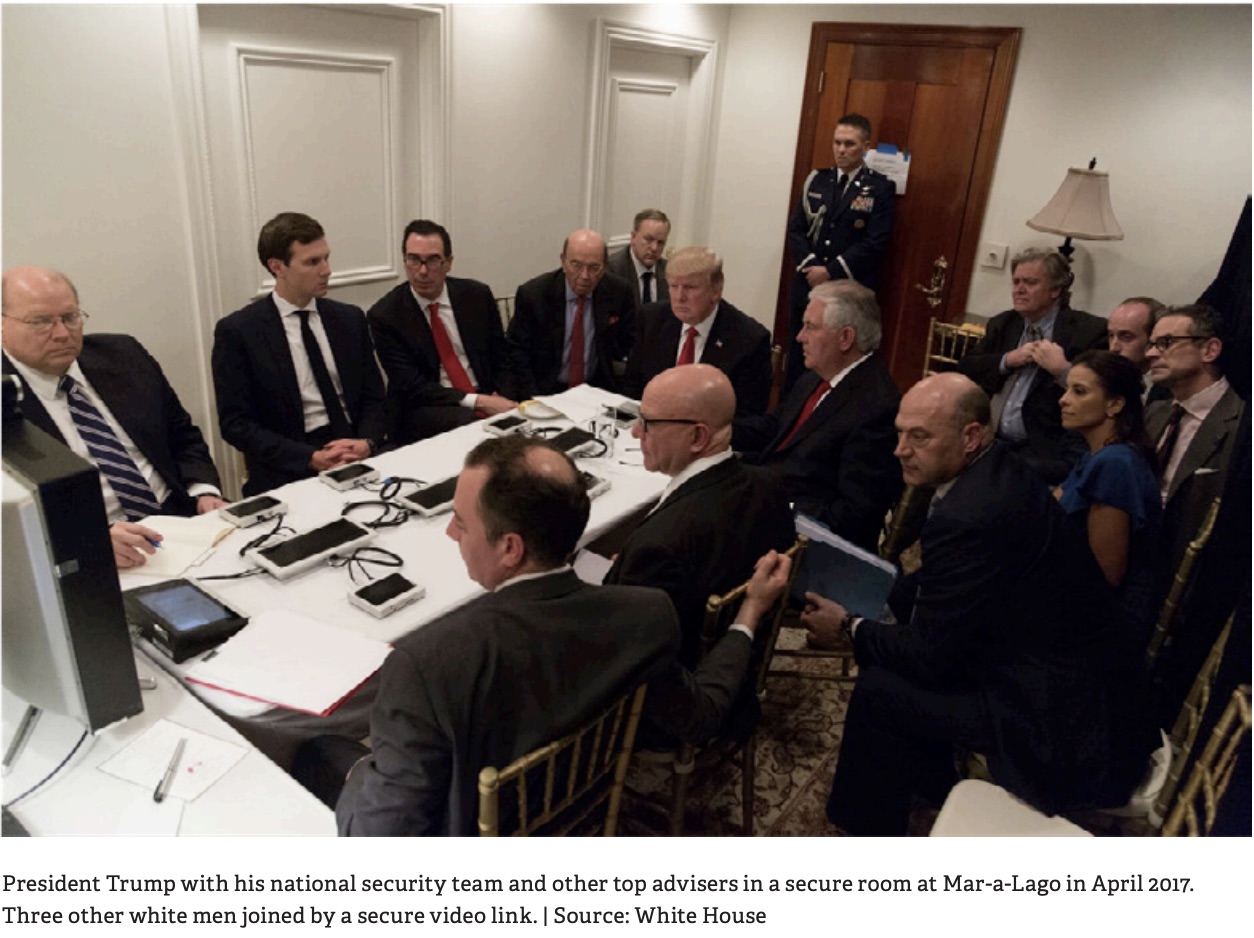

Or consider the board of directors of Theranos, the embattled blood-testing company that, once a darling of Silicon Valley, is now facing a series of lawsuits and fighting for its survival in the midst of a scandal over incorrect test results. Here are a few diversity indicators for Theranos’s outside directors in the fall of 2015, just before the scandal broke:

This lack of surface-level diversity is shocking, but it’s not all that unusual for the tech world— an industry that powerfully shapes how we work and live.

Engagement, not Enforcement

Even as companies implement diversity programs and spend more and more money promoting diversity, very little has changed over the years. After analyzing decades of data, researchers discovered something stunning: many of the most popular diversity programs—such as mandatory diversity trainings, formal job tests, and grievance systems—didn’t increase diversity. In fact, they made firms less diverse.

These initiatives often backfire because managers resist programs that police their actions or limit their discretion. But some programs—for example, voluntary diversity training, targeted recruitment, formal mentoring programs, and diversity task forces—do work.

One study showed that these programs boosted the number of female and minority managers in just five years, often by double-digit percentages. These strategies work because, instead of enforcing a list of dos and don’ts, they engage managers. They expose them to a wider variety of people. And they appeal to their desire to look good in the eyes of others. These soft tools make a big difference when it comes to building diverse teams.

Of course, diversity can’t solve all the problems of complexity. It’s just one of a portfolio of solutions, from redesigning systems and learning how to manage crises to changing the way we communicate and make decisions. But when paired with these solutions, diversity can be a powerful weapon as we navigate complex systems and try to prevent meltdowns.