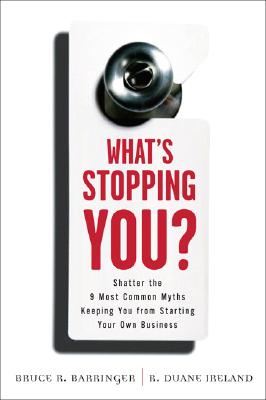

The following excerpt is the beginning of Chapter Three from the book What's Stopping You? : Shatter the 9 Most Common Myths Keeping You from Starting Your Own Business by Duane Ireland and Bruce R. Barringer.

The following excerpt is the beginning of Chapter Three from the book

What's Stopping You?: Shatter the 9 Most Common Myths Keeping You from Starting Your Own Business by Duane Ireland and Bruce R. Barringer.

The June '08 issue of Publisher's Weekly states:

This book is refreshingly pragmatic while still being encouraging; it addresses the obstacles at each stage of entrepreneurship, including overcoming psychological barriers to quitting a day job, identifying and developing the right idea, financing and running effective public relations and marketing campaigns on shoestring budgets. Simultaneously upbeat and instructive, this book offers the aspiring business owner a practical push toward taking the entrepreneurial plunge.

The book is nine chapters long, with each chapter exposing one of the "9 most common myths" and revealing its correspong truth. The myth of Chapter 3 is that "it takes a lot of money to start a business."

C H A P T E R 3

Myth No. 3:

It Takes a Lot of Money to

Start a Business

Truth No. 3:

It Might Not Cost as

Much as You Think

How much do you think it costs to start a business? If you're thinking about a biotechnology, semiconductor, or medical product firm, you'd probably say a lot, and you'd be right. But how much do you think it costs to start an average business, like the privately owned businesses you deal with every day? And where do you think the majority of the start-up capital for these businesses comes from? According to the Wells Fargo/Gallup Small Business Index, the average small business is started for about $10,000, with the majority of the money coming from the owners' personal savings.

[1]

If this figure strikes you as low, you're in good company; it strikes most people as low. That's because when most people think of businesses, they think of the types of businesses that they interact with the most frequently, like grocery stores, restaurants, gas stations, and large retail stores. These types of business do take a lot of money to start and run. But chances are if you start a business, it won't be like these businesses--at least initially. It will be more like the businesses highlighted so far in this book. Most of these businesses didn't take a tremendous amount of money to start. Even aggressive growth firms, in most cases, don't take an arm and a leg to get started. Each year Inc. magazine compiles a list of the 5,000 fastest-growing privately owned firms in the United States. In 2006, the medium amount it took to start one of the businesses on the list was $75,000.[

2] That means that half of them were started for less than $75,000. And these firms cover a wide swath of businesses, from building contractors to advertising agencies to retail stores.

There is somewhat of a catch, however, involved with starting a business with limited funds. The catch is that most people simply don't have any experience or insight when it comes to determining how much it will cost to start a business, how to economize on start-up expenses, or how to raise money if needed. These are topics that there is no reason to think about until you start seriously thinking about starting a business. To provide insight regarding these issues and to further dispel the myth that it takes a lot of money to start a business, this chapter is divided into three sections. The first section provides insights into how to think about money as it relates to starting a business. The second section focuses on the techniques that enable business owners to minimize the costs associated with starting a business. The third section focuses on the choices that small business owners have for raising start-up funds if needed.

Insights Into How to Think About Money as

It Relates to Starting a Business

For most people, the topic that consumes the majority of their thinking as it relates to money and starting a specific business is "How much money will it take to get the business off the ground?" While this question makes perfect sense, there is no concrete answer. The same exact business might cost one person $10,000 to start and another person $25,000--trust us, this isn't an exaggeration. The amount needed typically depends on how a person thinks about money as it relates to starting a business, how frugal a person is, and how resourceful a person is in gaining access to money and other resources.

While money is obviously needed to start even the most basic business, many of the observations that successful business owners make about money are surprising. While you'd think money would be held in high esteem, many business owners discount the importance of having plentiful funds as a key to new business success. Instead, they tend to see the absence of money as a motivator for developing qualities such as resourcefulness, creativity, focus, frugality, and drive.

The following are three insights about the role of money in the start-up process. As you read through each insight, think carefully about how each topic relates to your own attitudes about money. One of the reasons that many businesses are started for as little money as they are is that people adjust their attitudes about money as they become more acquainted with the start-up process.

Now let's look at three insights regarding the role of money in the start-up process.

Skimpy Finances Can Be a Blessing

Rather Than a Curse

The first insight regarding money and the start-up process is that there is a silver lining to having limited start-up funds. Many successful business owners, when they reflect back on their start-up years, feel that having limited funds forced them to focus, become self-reliant, and develop a mindset of frugality--qualities that have served them well as they've grown their firms. The importance of focus is affirmed by Caterina Fake, cofounder of Flickr, the popular photo-sharing Web site, which was started in 2002. In reflecting back on the role of money in the early days of her firm, Fake said:

The money was scarce, but I'm a big believer that constraints inspire

creativity. The less money you have, the fewer people and resources you

have, the more creative you have to become. I think that had a lot to do

with why we were able to iterate and innovate so fast.[3]

Flickr's first product was a multiplayer online game called Game Neverending. At one point mid-way through the development of the game, the programmers, on a lark, added an instant messenger application to the game's environment, which allowed users to form communities to share photos. Surprisingly, the photo-sharing feature quickly passed the game itself in terms of popularity. As the photo-sharing feature continued to gain momentum, the game itself was dropped because the company couldn't afford to work on both projects simultaneously.

Flickr, as a photo-sharing Web site, became extremely popular and was acquired by Yahoo! in 2005 for somewhere between 20 and 30 million dollars. Ironically, it was the lack of money, rather than the abundance of it, that caused the founders of Flickr to drop the game and focus on the photo-sharing site, a decision that turned out to be very profitable for the company.

In regard to developing a culture of self-reliance, having limited start-up funds often instills discipline in a firm and forces the founders to substitute ingenuity and hard work for financial resources. An example of how this played out in one firm is provided by Doris Christopher, the founder of The Pampered Chef. Christopher started The Pampered Chef in 1980 and ran the company out of her home well beyond its start-up years. Explaining how having limited start-up funds helped set her on a lifelong track of financial discipline, Christopher wrote:

With a bankroll of only $3,000 to start my business, I didn't have any choice; I had to watch my overhead. It taught me discipline, which I have been mindful of throughout my business career.[4]

The Pampered Chef, which was started in 1980, has been an enormously successful company. It sells kitchen utensils through home parties, utilizing a direct sales approach (like Tupperware). At last count, the company had nearly 70,000 Pampered Chef consultants and 12 million people attending its home parties each year. To this day, the main theme of Christopher's speaking and writing is to caution business owners to avoid debt, minimize overhead, and remain self-reliant.

Finally, limited funds at the outset often help a firm develop a mindset of frugality--a quality that is often very helpful as a firm grows and expands. For example, many businesses that are started on a shoestring learn to function very inexpensively and continue to watch their money very carefully, even after they become successful.

Raising or Borrowing Money Is

Trading One Boss for Another

The second insight regarding the role of money and the start-up process has to do with raising equity capital or borrowing to fund a business. One of the first things that many people do when they decide to start a business is to try to raise money through a bank or an investor. There are several choices that business owners have for raising money, including commercial banks, SBA guaranteed loans, investors, grants, supplier financing, and several others. Of these choices, many people automatically assume that the only way they'll raise the amount of money they need is via a commercial bank or an equity investor. While the other choices might hold promise, most people's initial reactions are that the alternatives pale in comparison to the amount of money that can be raised from a bank or through an investor.

While in some cases it is necessary to go the bank or investor route, the problem with obtaining money from these sources is that there are consequences that business owners often don't fully anticipate. Bankers and investors typically assert considerable control over the businesses they provide money to as a means of protecting their investments. While the majority of bankers and investors have good intentions, the level of scrutiny and control their investments allow them often has an impact on the firms they fund. For example, banks are inherently conservative and often caution their clients to grow slowly, while investors are the opposite and regularly pressure the companies they invest in to grow quickly to increase their valuations. What's missing here is what the business owner wants. So for people leaving traditional jobs to start their own businesses, obtaining money from bankers or investors is often like trading one boss for another. You might be freeing yourself from working for a boss in a traditional sense but could have an equally influential boss in the form of a banker or an investor.

An additional consideration when taking money from an investor is that you exchange partial ownership in your business for funding. This aspect of the small business owner–investor relationship can also be problematic. Unlike the business owners introduced in this book, who started their businesses to fulfill personal aspirations or follow their passions, the majority of investors are not in it for the long term--they want their money back in three to five years along with a sizeable return. This means that a business owner like Daryn Kagan, the former CNN reporter who started a "good news" Web cast, will probably have to sell her business in three to five years from the time it was started if she accepted investment capital. Although this scenario will undoubtedly net Ms. Kagan a handsome financial return, assuming her business is gaining traction and is profitable, she'll lose direct control of the business she was so excited to create.

The solution to avoid these potential problems is steering clear of bank financing or equity funding or, at the minimum, having a clear understanding of the nature of the relationship you'll have with your banker or investors. It's possible for a small business owner to have a healthy relationship with a banker or an investor. The overarching point, however, is that small business owners should go into these relationships with their eyes wide open, fully understanding the parameters of the relationships they're developing.

Excess Funds Can Enable a start-up to Operate

Unprofitably for Too Long

The third insight regarding money and the start-up process is that having excess funds often masks problems and enables a firm to operate unprofitably for too long. Many businesses lose money their first several months while they ramp up and gain customers. That's normal. But at some point, a business has to operate profitably to prove that it is a viable, ongoing pursuit. People who start businesses with limited funds typically find out quickly if their businesses are capable of turning a profit. Because they don't have excess funds to rely on, they must make adjustments quickly, like cutting expenses or increasing sales, to turn a profit. Ultimately, if the business doesn't work, it is shut down. In contrast, if a person starts a business with abundant funds, the business can operate for months at a loss and stay open if the owner relies on excess funds to keep the business afloat. The owner may never feel pressured to cut costs or generate additional sales, thinking that the business simply needs more time to prove itself. If the business ultimately fails, it will normally lose more money and more of its owner's time and prestige than the less well funded startup.

A related complication associated with having abundant funds is that a business's cost structure and clientele is often determined by the amount of money it has initially. For example, if you decided to open a clothing store and were offered $200,000 by an investor to start the business, you might rent space in an upscale mall, hire experienced salespeople, buy the latest computer equipment, and launch an expensive advertising campaign. While this sounds good, once the business is started and the $200,000 is gone, you might be locked into a high overhead business that has to sell high margin products to an affluent clientele to make the business work. Conversely, if you had started with less money, you might have signed a shorter term lease in a more modest facility, hired your initial salespeople part-time to see which ones worked out the best, bought used computer equipment, and found inexpensive ways to spread the word about your store. Utilizing this approach, you'd actually have more flexibility and room to maneuver than the better funded scenario.

Collectively, the purpose of these three insights is to put the importance of money in starting a business in its proper perspective. While many people think, "If I only had the money, I'd start my own business," the insights provided here show that having money isn't a panacea. In fact, the discipline imposed by having limited funds is often an advantage and creates a healthier business in the long run.

The following excerpt is the beginning of Chapter Three from the book What's Stopping You?: Shatter the 9 Most Common Myths Keeping You from Starting Your Own Business by Duane Ireland and Bruce R. Barringer. The June '08 issue of Publisher's Weekly states:

The following excerpt is the beginning of Chapter Three from the book What's Stopping You?: Shatter the 9 Most Common Myths Keeping You from Starting Your Own Business by Duane Ireland and Bruce R. Barringer. The June '08 issue of Publisher's Weekly states: